How to Update Your Dynamics GP Payroll Tax Tables

- Log in to GP as sa

- Choose Microsoft Dynamics GP – Maintenance – US Payroll Updates – Check for Tax Updates

- You will be asked for your authorized number. Enter the phone number you used when registering Dynamics GP. Not sure what that is, or is the number you entered not working? Ask your GP partner. Or, if you are an existing Dynamics GP Payroll client of Intelligent Technologies, Inc., try ours. (3363153935)

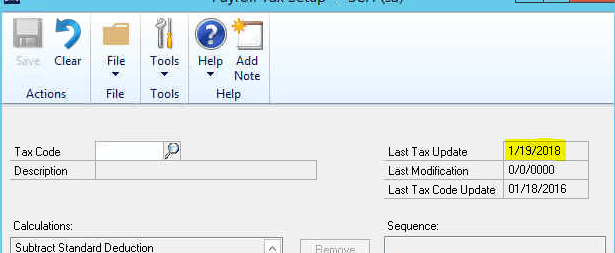

- Verify that you have the latest Dynamics GP Payroll tax tables installed. Navigate to Microsoft Dynamics GP – Tools – Setup – System – Payroll Tax. If you have the latest updates installed the “Last Tax Update” date in the upper right hand corner of the screen should read “1/19/18. See screenshot below.

Questions? Leave a comment or contact your Dynamics GP partner. Don’t have a GP partner? We can help!